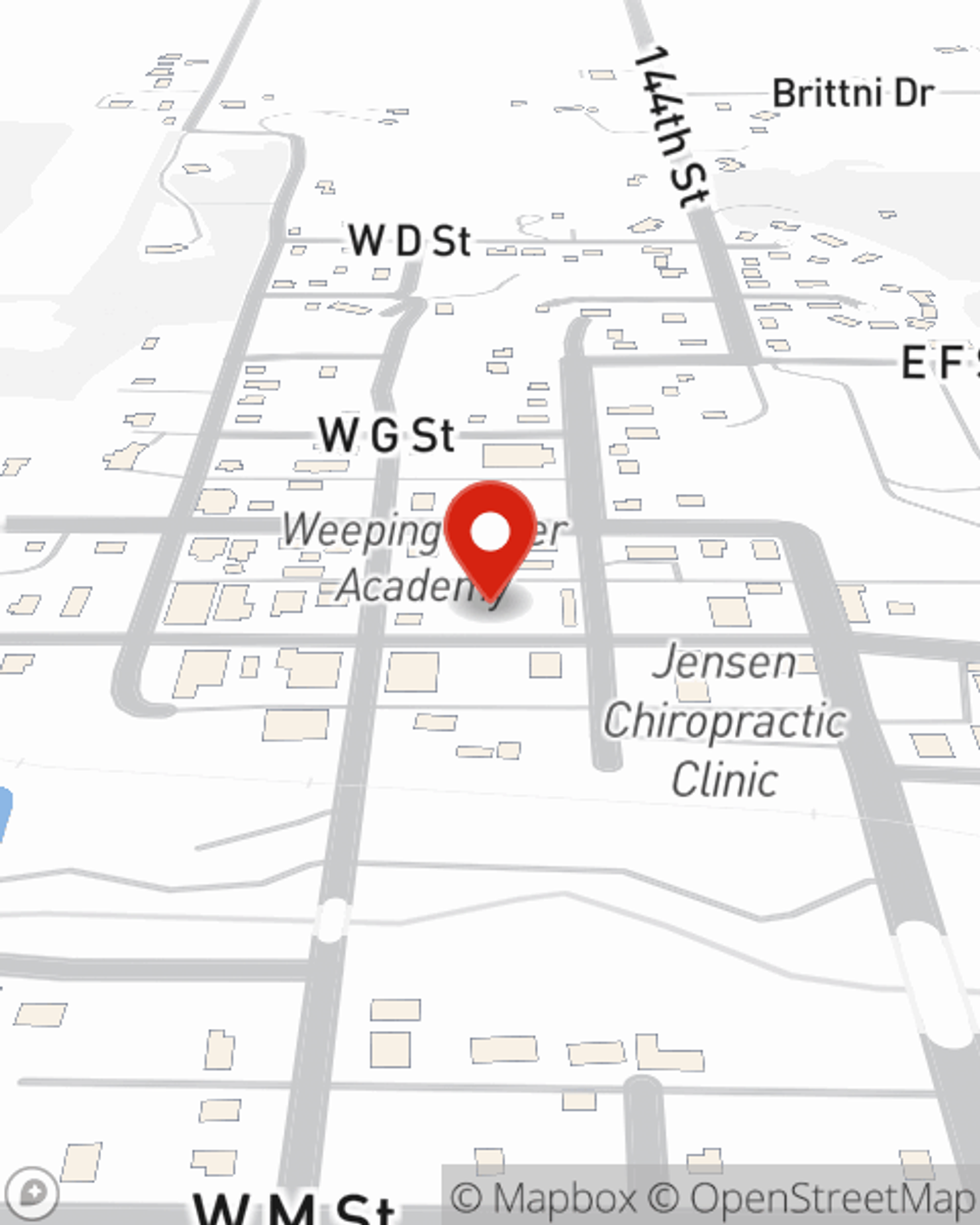

Auto Insurance in and around Weeping Water

Looking for great auto insurance in Weeping Water?

Insurance that's the wheel deal

Would you like to create a personalized auto quote?

- Weeping Water

- Cass County

- Otoe County

- Syracuse

- Elmwood

- Murdock

- Avoca

- Louisville

- Springfield

- Manley

- Union

- Cedar Creek

- South Bend

- Murray

- Nehawka

- Eagle

- Alvo

- Ashland

- Greenwood

- Palmyra

- Unadilla

- Otoe

- Burr

- Sarpy County

Your Auto Insurance Search Is Over

When you’re out and about, staying in motion is important. Because darting deer or falling tree branches can happen to anyone, anytime, you need car insurance coverage you can count on.

Looking for great auto insurance in Weeping Water?

Insurance that's the wheel deal

Great Coverage For A Variety Of Vehicles

With State Farm, get revved up for wonderful auto coverage and savings options like collision coverage medical payments coverage, accident-free driving record savings a newer vehicle safety features discount, and more!

So don’t let theft or flying objects stop you from moving forward!

Have More Questions About Auto Insurance?

Call Brian at (402) 267-3435 or visit our FAQ page.

Simple Insights®

What is Medical Payments Coverage?

What is Medical Payments Coverage?

Learn what medical payments coverage is, how it helps pay medical bills after a car crash regardless of fault and why it might be right for you.

Help make your commute safe and sane

Help make your commute safe and sane

Want a safer commute? There are things you can do to help make sure you commute safely, such as eliminating distractions. Read these tips from State Farm.

Brian Gross

State Farm® Insurance AgentSimple Insights®

What is Medical Payments Coverage?

What is Medical Payments Coverage?

Learn what medical payments coverage is, how it helps pay medical bills after a car crash regardless of fault and why it might be right for you.

Help make your commute safe and sane

Help make your commute safe and sane

Want a safer commute? There are things you can do to help make sure you commute safely, such as eliminating distractions. Read these tips from State Farm.