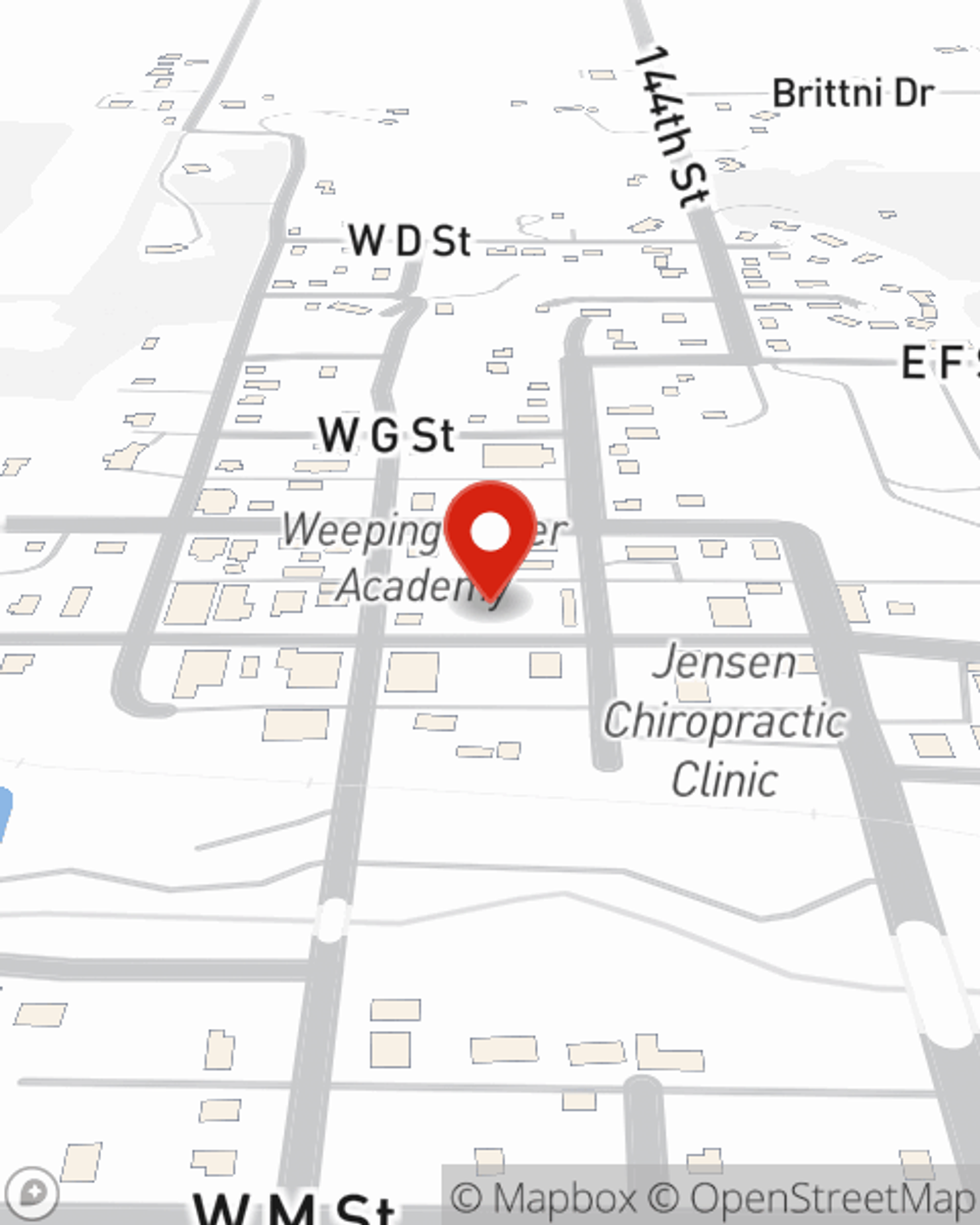

Business Insurance in and around Weeping Water

One of Weeping Water’s top choices for small business insurance.

Insure your business, intentionally

- Weeping Water

- Cass County

- Otoe County

- Syracuse

- Elmwood

- Murdock

- Avoca

- Louisville

- Springfield

- Manley

- Union

- Cedar Creek

- South Bend

- Murray

- Nehawka

- Eagle

- Alvo

- Ashland

- Greenwood

- Palmyra

- Unadilla

- Otoe

- Burr

- Sarpy County

Insure The Business You've Built.

Operating your small business takes effort, commitment, and great insurance. That's why State Farm offers coverage options like business continuity plans, extra liability coverage, errors and omissions liability, and more!

One of Weeping Water’s top choices for small business insurance.

Insure your business, intentionally

Small Business Insurance You Can Count On

At State Farm, apply for the great coverage you may need for your business, whether it's a book store, an antique store or a psychologist office. Agent Brian Gross is also a business owner and understands your needs. Not only that, but exceptional service is another asset that sets State Farm apart. From one small business owner to another, see if this coverage comes out on top.

Get right down to business by calling or emailing agent Brian Gross's team to explore your options.

Simple Insights®

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Brian Gross

State Farm® Insurance AgentSimple Insights®

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.